Kroger Paystub & schedule: One significant way Kroger has achieved this is through its pioneering approach to employee scheduling, known as the Kroger E-Schedule system. This article will delve into Kroger Paystubs, exploring everything from its purpose and accessibility to understanding the components.

Guide to Kroger Paystubs

Kroger, a retail behemoth in the United States, not only caters to the daily shopping needs of countless Americans but also takes care of its extensive workforce. One crucial aspect of this commitment is the Kroger Paystub, a vital tool that enables employees to track their earnings, deductions, and financial information.

1. Understanding the Basics of Kroger Paystubs:

Kroger Paystubs, or paychecks or pay stubs, are detailed documents issued to employees regularly. These documents show an employee’s earnings and deductions during a specific pay period.

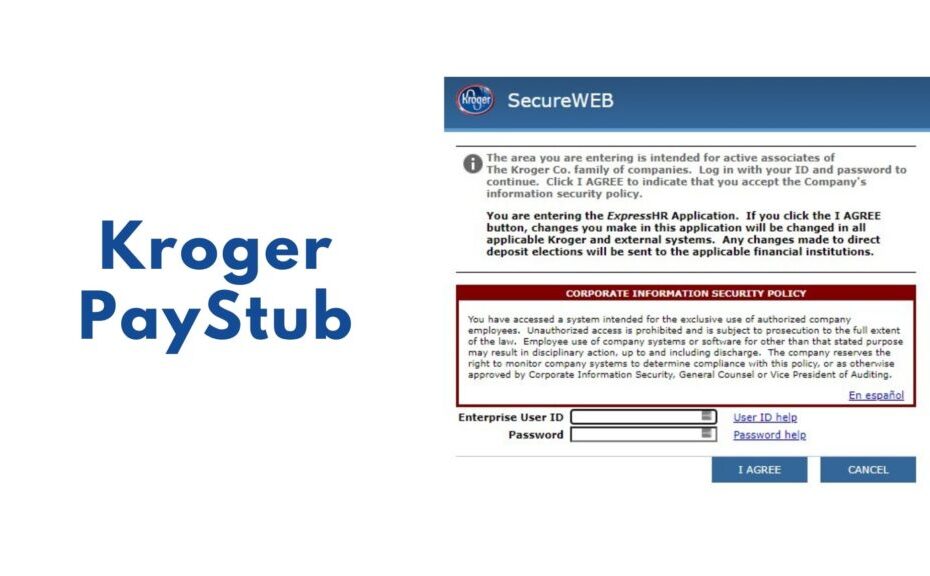

2. Accessing Kroger Paystubs:

Kroger recognizes the importance of accessibility. Employees can access their paystubs through various channels, including the company’s official website and employee portal, or by contacting the HR department for assistance.

3. Online Convenience:

The company’s online employee portal is one of the most popular methods for accessing Kroger Paystubs. This feature offers convenience and efficiency, allowing employees to view, download, and print their paystubs from the comfort of their homes.

4. Key Components of Kroger Paystubs:

Kroger Paystubs comprises various sections, including gross pay, deductions, net pay, and important tax-related information. Understanding these components is essential for employees to manage their finances effectively.

5. Gross Pay Breakdown:

This section details an employee’s total earnings before any deductions are applied. It includes regular wages, overtime, and any bonuses or incentives earned during the pay period.

6. Deductions and Withholdings:

Kroger Paystubs outline various deductions, including taxes, insurance premiums, retirement contributions, and other authorized deductions. Understanding these deductions is crucial for employees to gauge their take-home pay accurately.

7. Net Pay:

The net pay section represents the amount an employee receives after all deductions have been applied. It is the actual amount deposited into the employee’s bank account.

8. Tax Information:

Kroger Paystubs provide detailed tax information, including federal and state tax withholdings. This section is crucial during tax filing season and aids in ensuring accurate tax returns.

9. Year-to-Date Totals:

Kroger Paystubs typically include year-to-date totals for various earnings and deductions. This information helps employees track their financial progress over the year.

10. Staying Informed and Financially Savvy:

Kroger Paystubs are a valuable resource for employees to stay informed about their earnings and deductions. Regularly reviewing their paystubs allows employees to budget effectively, plan for expenses, and make informed financial decisions.

Kroger’s E-Schedule Revolution

In the ever-evolving landscape of the retail industry, Kroger has not only managed to remain a household name in the United States but has also continued to innovate and adapt to meet the changing needs of its customers and employees.

Efficiency and Flexibility:

Kroger’s E-Schedule system has ushered in a new era of efficiency and flexibility in employee scheduling. Gone are the days of static paper schedules that were cumbersome to update and left little room for adjustments.

Employee Empowerment:

One of the standout features of Kroger’s E-Schedule is its degree of employee empowerment. Kroger associates can access their schedules remotely through an easy-to-use mobile app or website, giving them greater control over their work-life balance. This transparency fosters a sense of trust and engagement among employees, as they can request time off, swap shifts, or pick up additional hours with ease.

Adaptive Scheduling:

The retail industry is no stranger to fluctuating demand, and Kroger’s E-Schedule system is designed to address this challenge effectively. Store managers can utilize historical data and real-time sales information to make informed decisions when creating schedules.

Reducing Labor Costs:

Effective labor cost management is crucial in the retail sector, and Kroger’s E-Schedule system is pivotal in achieving this goal. The company can better control labor expenses without compromising service quality by automating scheduling processes and optimizing labor allocation.

Conclusion:

Kroger’s E-Schedule system is a testament to the company’s commitment to innovation and to improving the lives of its employees and customers. Kroger has set a benchmark in the retail industry by streamlining scheduling processes, empowering employees, and adapting to changing demands.